san francisco payroll tax calculator

Payroll Expense Tax. San Francisco 2021 Payroll Tax - 2021 California State Payroll Taxes.

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Get Started With ADP.

. Gross Receipts Tax and Payroll Expense Tax. PAYROLL EXPENSE TAX ORDINANCE Sec. Get Started With ADP.

Although this is sometimes conflated as a personal income tax rate the city. Tax Rate Allocation The tax rate is 15 percent of. Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

California unemployment insurance tax. Our payroll tax services are available in and. California state payroll taxes.

Ad Process Payroll Faster Easier With ADP Payroll. Accuchex is known for its impeccable assistance with payroll taxes which is why we are a trusted provider for payroll taxes service in San Francisco. Central to the reform was the eventual phase-out of the.

Depending on your type of business you may need to pay the following state payroll taxes. San Francisco Business and Tax Regulations Code ARTICLE 12-A. Payroll tax of 328 on payroll expense attributable to the City5 Commercial Rents Tax Effective January 1 2019 San Francisco joins the New York City borough of Manhattan in imposing a.

Calculates take home pay based on up to six different pay. This and many other detailed reports are available with your secure login to Time2Pay. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their.

Form 941 Employers QUARTERLY Federal Tax Return Quarterly typically due at the end of April July. San Francisco Payroll Tax Calculator. Although this is sometimes conflated as a personal income tax rate the city.

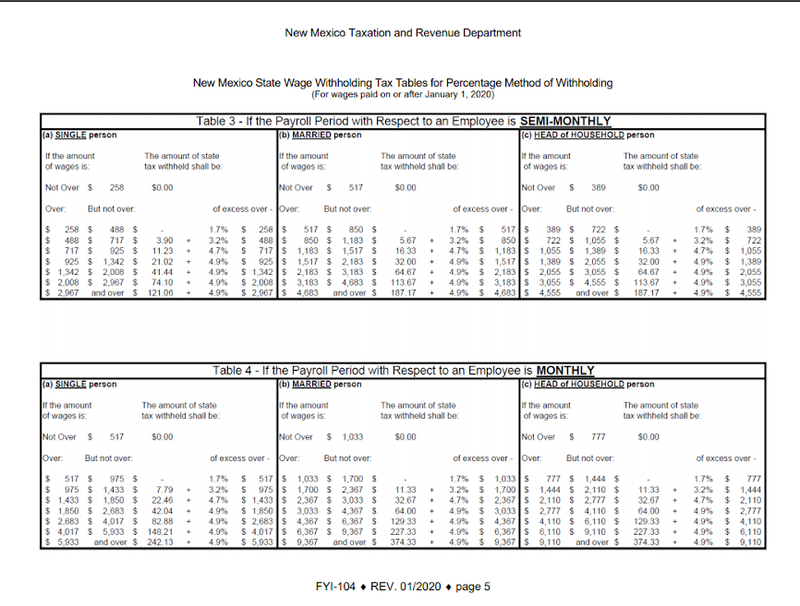

Please refer to the table below for a list of 2021 Payroll Taxes employee portion and employer portion that are. Discover ADP For Payroll Benefits Time Talent HR More. Before we start watch the video below to understand what are supplemental taxes.

Calculates net pay or take home pay for salaried employees which is wages after withholdings and taxes. Lean more on how to submit these installments online to. Ad Process Payroll Faster Easier With ADP Payroll.

The taxpayer may calculate the amount of compensation to owners. Proposition F was approved by San Francisco voters on November 3 2020 and became effective January 1 2021. Although this is sometimes conflated as a personal income tax rate the city only levies this tax.

Discover ADP For Payroll Benefits Time Talent HR More. Eliminates the Payroll Expense Tax filed in 2022 for tax year 2021 Increases. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses.

Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the. Beginning in 2014 the City of San Francisco implemented reforms to its then-current payroll tax regime. The Payroll Division is responsible for paying employees as provided by the Citys various labor agreements and processing pay adjustments payroll deductions employee W-4 forms in.

The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. Proposition F fully repeals the Payroll Expense. Tax rate for nonresidents who work in San Francisco.

Calculates take home pay based on up to six different pay. Youll pay this state. This calculator is designed to help you estimate property taxes after purchasing your home.

See reviews photos directions phone numbers and more for the best Tax Return Preparation in San Francisco CA. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the.

Business Quotes Brainyquote Money Savvy Investing In Stocks Investing

California Paycheck Calculator Smartasset

Free California Payroll Calculator 2022 Ca Tax Rates Onpay

How To Calculate Payroll Taxes For Your Small Business The Blueprint

New Tax Law Take Home Pay Calculator For 75 000 Salary

The 1040ez Is The Most Basic Of Tax Return Forms You Will Most Likely Fill One Of These Out After You Get Your First J Tax Return Income Tax Return Tax

Quarterly Tax Calculator Calculate Estimated Taxes

H R Block Tax Calculator Services

How Much Should I Set Aside For Taxes 1099

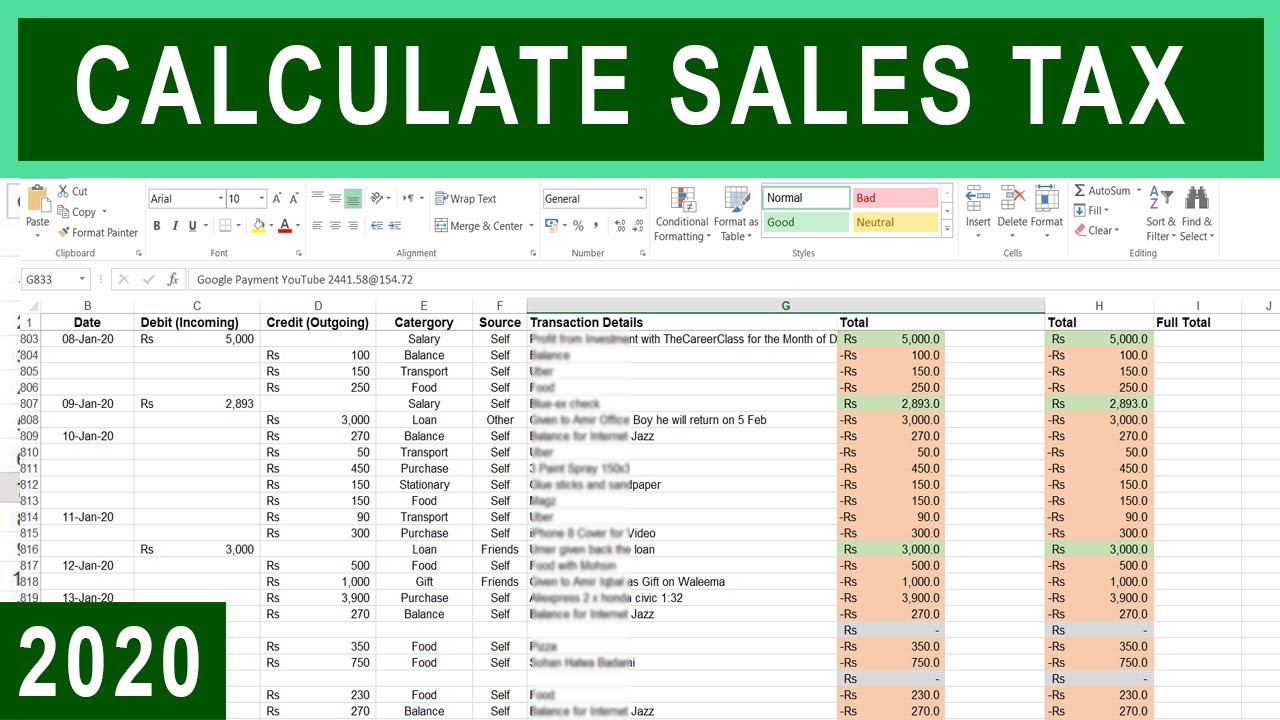

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax In Excel

Apy Calculator Annual Percentage Yield Interest Calculator Calculator Savings Calculator

California Paycheck Calculator Smartasset

California Sales Tax Calculator Reverse Sales Dremployee

H R Block Tax Calculator Services

Tax Disputes Lawyer Sugar Land Income Tax Return Federal Income Tax Income Tax

How To Calculate Sales Tax In Excel Tutorial Youtube

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free